Here’s something new: wet weather in parts of Victoria now means farmers must be paid less for their milk.

MG came out with another adjustment to the milk price on Thursday. In a nutshell, the MSSP (aka the “Clawback”) has been put on ice. At the same time, the best price MG expects to be able to offer farmers this season (called the “closing price”) has been revised down by a little bit more than the “clawback of the clawback” returned to farmers’ pockets.

I must admit that while I was expecting the clawback of the clawback, I wasn’t expecting MG to revise down the forecast closing price because analysts are cautiously optimistic that the global market for milk is recovering. It’s supposed to be all up from here.

The problem is MG forecasts its milk intake to be 20 per cent lower this season and, after stuffing warehouses full of surplus product last year, it now doesn’t have enough product to sell. Conceding losing 350 million litres to retirements and competitors, MG blames the remainder of the loss on wet weather. The reality is that the weather is just one part of the equation. The main reason production is down is man-made and does not rate a mention by MG: the low milk price.

Low milk prices mean less milk production

The low milk price hits production in two important ways:

- Cows are sold, leaving fewer in the herd producing less milk per farm

- Cows are fed less grain and produce less milk per cow

Fewer cows in the dairy

The grim reality is that most Victorian dairy cows are worth more at the saleyards than in the dairy this year. Farmers culled their herds during last year’s drought and, now, many struggling to pay the bills have culled hard again.

Less milk-producing feed

The cows that remain in the herd are being fed less grain than last year, simply because it’s not viable. Here in Gippsland, we are paying $310 per tonne for supplementary feed. The rule of thumb is that a kilogram of grain returns a kilogram of extra milk.

Right now, my own farm is getting 26.9 cents per litre during Spring (while most MG suppliers will be getting even less), so we lose roughly 4 cents per litre with every extra kilo of grain. We just can’t afford to produce more milk beyond what’s needed to service our overheads and keep the cows healthy.

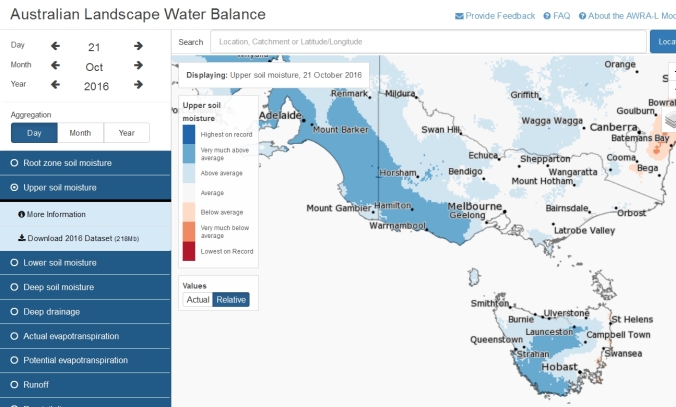

It’s not actually that wet for MG – at least, not everywhere

The other mystifying statement about the claim that wet weather is the cause of the loss of production is that, actually, large areas of MG’s supply area aren’t experiencing record wet conditions and some areas are having a bumper season.

Source: Bureau of Meteorology

Yes, the south-west of the state, South Australia and parts of Tasmania are having a terribly wet season but Gippsland and the north are not, if you are to believe the Bureau of Meteorology.

Dairy Australia figures from last year show the production of each area:

| Financial Year 2015/16 | ||

| RDP | Litres | % |

| Dairy SA | 514,039,216 | 5% |

| DairyTas | 882,965,394 | 9% |

| DairyNSW | 792,948,581 | 8% |

| GippsDairy | 2,006,004,931 | 21% |

| Murray Dairy | 2,267,951,005 | 24% |

| Sub-tropical Dairy | 550,148,921 | 6% |

| Western Dairy | 387,147,057 | 4% |

| WestVic | 2,139,492,819 | 22% |

| Grand Total | 9,540,697,924 | 100% |

Of these, it’s only fair to remove DairyNSW, Sub-tropical Dairy and Western Dairy because these areas are either not collected by MG or have special pricing not affected by the announcement.

If you assume all of Dairy SA, DairyTas and WestVic are hit by the wet but GippsDairy and Murray Dairy are okay, the picture is not nearly so dire. In fact, the source of 55% of the litres in MG’s supply area isn’t too wet at all!

So, yes, the wet is a problem – an especially big problem for farmers in the south-west who have my sympathies – but unlikely to be anywhere near as big a problem as last year’s drought, which affected pretty much the entire collection area.

If anything, the processor most affected by the weather may well be Warrnambool Cheese & Butter and it increased its milk price to $5.00 per kgMS in late September. The MG milk price (without the now suspended MSSP) is now $4.60 per kgMS and the forecast is for $4.70 by the end of the season. Ouch.

The bottom line

It all boils down to this: low milk prices lead to lower milk production – even in a reasonable season – and make it even harder for farmers to cope with difficult seasons.

What Thursday’s announcement from MG reveals is that farmers now face a vicious cycle, given the expected loss of 20 per cent of the co-op’s milk supply since last season.

The challenge for MG’s board now is to stop another closely-related vicious cycle from spiralling out of control, as it did for its once-great competitor co-op, Bonlac. That would be a dreadful outcome for our entire industry.

I wonder what would happen if another processor stepped up and offered M/G shareholders say$2/share and $5/kg M/S? It needs 90% of the “wet” shareholders to say yes but would they be enticed by such an offer?

LikeLike

I have been talking for some time about the “price of trust” the cost of breaking the trust and an even higher cost of “attempting” to repair the break.

I don’t believe MG board is aware of the two costs and see things in financial terms alone. My take is … sadly if ever will MG rebuild the trust it used to have. The cost to the industry has yet to be felt. We know who to thank for that … one gone one to go, for starters.

LikeLike

I would suggest 2 gone 3 to go…and yes the invisible bond with its owners/suppliers has been broken well and truly. Bonlac debacle all over again about to happen. Bega and Norco sitting in good positions right now but not sure they can upscale fast enough, maybe another (yet unknown to many) co-op is emerging is in the wings to replace what MGC once was.

Good article, albeit hard hitting but certainly realistic and plain speaking.

LikeLike

Confused drenched city dweller my one down is the ex CEO. The Chairman absolutely has to go … he’s in total denial and arrogant to the max.

LikeLike

Gary Helou and Brad Hingle makes 2, the other 3 would be 2 execs and 1 board member, possibly 2 board members if the advocate for Gary is included.

To James, in regards a replacement to MGC as the prevailing Aussie co-op I wasn’t referring to Bega. Perhaps my wording of the sentence was poor.

LikeLike

Perhaps this is the time to merge MG with the Bonlac supply agreement, tap into Fonterra’s massive international marketing network and take control over the supermarkets again. The Australian co-op could run in parallel to, (but not taken over by) the management and board. The competition is massive world scale companies like Danone, Kraft Saputo etc, not local brands. NZ faced the same decsion years ago, merge, or be taken over by a giant. Domestic competition is not the solution long term.

LikeLike

Bega is not a Co -op anymore.

LikeLike

Andrew,

Not a bad suggestion at all, not too sure how it would all come together and what the interest from industry and Canberra would be for this type of approach but worthy of consideration at least if they agreed to remain a co-op and somehow restructured the ASX listed units akin to the Fonterra FSF units or delisted from the ASX all together.

The AGM and latest announcement has at least indicated a sunsetting of the Chairman and the other Board advocate of Gary Helou’s approach.

Let’s see who comes out as the top exec and what their views are on this idea, if the in-house candidate it might not get much traction.

If nothing else the winds of change are, yet again, upon the dairy sector and let it be for the betterment across the whole supply chain this time. The farming side could certainly do with a break and some market based relief.

LikeLike

All inevitable unfortunately. The cycle continues to repeat itself for the nearly 40 years that I have been dairying and every time the numbers of farmers decline along with national milk production yet we keep looking to the same solutions.

The national milk pool that would take ownership over the element of supply is the only way to save family farmers and food security in Dairy in Australia.

LikeLike

MG definitely has some major challenges ahead. Problem is they are either too stupid or just too arrogant to realise that the engine needs a complete rebuild. Doesn’t matter how many coats of paint you put on an old car, if the engine is stuffed, no one’s going to trust it to make the distance.

LikeLike

Good call Marion on the spin for what it is. It beggars belief that they think we would swallow such rubbish. It is very clear that if there was enough capacity across the industry MG would have no milk. The only reason they have “got away” with corporate thuggery to date, is that the industry does not have the capacity to absorb all their supply. The other major unethical corporate bully also sits in this category.

2017 will see two new competing plants come on line and completion of smaller upgrades by other competitors. This could see the departure of at least another 400 million litres from MG…. If we think they are weakened now, what will be left by late 2017? I’m guessing, that once the 2016 Spring peak milk flow passes, competitors to MG will start taking new supply, on the expectation of works being complete (to increase capacity) before the Spring peak of 2017.

Let’s hope it isn’t too late, but some serious changes are required – starting with a skills based board. A regionally representative popularity contest is no way to select the board of (what was) a $4 billion company. While a highly skilled, professional board is no guarantee of success (and the ASX is littered with failures of same); the reality is, most farmer directors are no match for a head strong, highly effective spin merchant bully of a CEO.

Across the industry we need strong, well lead companies with world class products and production efficiency. Strong linkages with our markets and consumers are imperative. Trust, transparency and ethical behaviour is paramount from producer to consumer. Anything less is unacceptable to the Australian community. Down Down is the ultimate outcome for those who breach any of these terms of operating in our free market economy. Spin doctoring works for a while, but reality catches up with everyone.

LikeLike

Tyran, the reason that MG has done what they have is because they can. The contracts signed across the industry allow the processors to leave all the price risk with the farmers in exchange for exclusive supply.

The same with the ‘Down Down’ you referred to. Coles did that because the contracts allowed them to.

You say that you want ‘strong, well-led companies’ and that is what you have. A strong well-led company will leave as much of their risk with the farmers as they can. MG are so strong that they announced a handy profit for the year. Fonterra and Bega too. Lion and Parmalat probably also. The companies are already what you said you want. Strong. Well-led.

The solutions are not in the make-up of the MG board.

What you need now are strong farmers to overturn the contracting system. The ball is firmly in the court of the ADF. It has been in the ADF’s court since deregulation 16 years ago. Unfortunately, the ADF has accepted the money the processors pay as processor money – when it has been deducted from the farmers’ milk payments. For this, the processors have control of the ADF. The small amount the SBFO’s pay is nearly insignificant.

The farmers don’t totally control their own representative group. As you say, ‘the farmers are no match for the influence of a strong, highly effective spin merchant’. They have been spun out of their own ADF.

While ever the situation remains unchanged, New Zealand will leave the Aus dairy industry further and further behind. As it clearly has for the past 16 years.

LikeLike

Tyran, could you or the ADF please provide a quantitative analysis of what is going to set milk prices in Victoria in a time such as you envisage MG is no more? And by quantitative analysis I mean something more than simplistic presumptions of supply and demand.

Have mistakes happened at MG? Clearly yes. Is the current bleeding of supply effecting its ability to pay? Clearly yes. Are such comments as yours going to rattle loyal suppliers of MG. Clearly yes.

And yet no one mentions that competition between milk processors only drives price up until the point where it limits the ability price setter to pay. Clearly Saputo, Fonterra and Burra are not benevolent societies and once their capacity is full I do not see them passing on what rises they can. Bega continues to look after South east New south Wales.

Every year since deregulation my analysis has been that there is either pre-emptive or price matching behaviour to whatever MG Co-op pay, plus a cent or 2 of course.

Clearly things could have been managed better at MG. But the constant attack is doing more damage. I dispute the argument that having unit (or bond) holders does not make it a co-op.

So I would like to see some proper price dynamic analysis. As a farmer who has bought my farm on the confidence of MG Co-op being there to drive price it shakes me to the core reading attacks with such flimsy assumptions of what is going to happen if it isn’t there.

LikeLike

Hi Tim,

Thanks for your comment. Are you suggesting that everyone must praise MG, no matter what it does, in case critical discussion breaks it?

LikeLike

I believe in proactive protecting and nurturing and using democratic process. No problem with critical discussion but constant attack which feeds competing companies without a thought of consequences is dangerous.

Which takes me back to my question. What is going to drive milk price when private companies are content with supply and MG is no more? I want discussion.

Of course we could end up like potato growers dealing with Mr McCain. No power. Just ability to hold up placards.

As I see MG as a group of farmers who stick together for the betterment of the industry, being one who will be loyal to the end even though I have more debt than most I feel the pain of the constant negativity toward my co-op.

LikeLike

I think it’s fantastic that farmers are discussing the changes in the industry with such vigour. It worried me that so few voted (either way) on the float.

Simply going along with the flow is more dangerous than questioning its direction.

We’ll know we’re in real trouble when farmers cannot be roused in situations like these.

LikeLike

And that’s the first mistake. MG stopped being a true co-op many years ago. Relying on the non-benevolent parent to look after the farmers best interests will surely end in tears.

LikeLike

The chasing of the unicorn over the rainbow in pursuit of the MG dream has been one of the biggest factors destroying the future of our dairy industry. The vision of Gary was always to strive to turn MG into the equivalent of Fonterra in NZ. A monopoly processor controlling the majority of supply.

As we have seen at the farm gate a monopoly of supply by the processor does not benefit the producers. The only way to reverse that is if the producers own a monopoly of supply.

Profits continue to be made in the dairy sector by processors and retailers but not by the majority of producers.

MG ceased to be a true Co-op many years ago and to blindly follow is surely going to see a repeat of the Bonlac saga of years ago.

LikeLike

It is disappointing that the ADF cannot be a becon and a shining example of this strong leadership you seek and demand Mr Jones. We need strong and well run industry representatives organisations that can show that they can work together .Just as much as we need a strong and well run co-op to be the foundation of a strong Australian dairy industry. Both if badly run does no one any service. They both need to be the strong voice of Australian dairy and well run.

LikeLike

Marian thank you so much for taking the time to analyse what’s happening out there and write about it it so clearly. Much appreciated!

LikeLiked by 1 person

Thanks Rachel. I’m trying!

LikeLike

With no comment thus far on what will drive milk prices in the absence of MG or a strong MG, let me continue with an example of a country with ample competition, yet, perversely no one driving milk price. In the UK there is plenty of choice of processor, yet when dairy commodities run there is no company that will take the lead to pass the benefits on. Why would they? But hey, doesn’t competition drive price? Yes, but only to the point that the price setter is weakened or disappears. Now let us ponder Australia and consider what the aims of Saputo, Fonterra or parmalat may be? No unicorns, just an inconvenient truth.

LikeLike

Yes,Tim Dwyer. Nicely put. The UK and Australian dairy industries are global examples of what not to do. Pure competition has not worked because the farmers have been disempowered under the contracting systems. The Dairy Connect reps that just returned from the IDF in Rotterdam said exactly that. Those countries that have allowed the processors to control their industries have fallen away. https://dairy.ahdb.org.uk/resources-library/market-information/supply-production/world-milk-production/#.WBZ1L-N96Uk

2000 2013

AUS 10.85 9.52

Brazil 20.4 34.25

Canada 8.16 8.39

Denmark 4.7 5.1

France 25.0 23.7

Germany 28.3 31.1

Ireland 5.16 5.58

Netherlands 11.15 12.21

NZ 12.23 18.88

Russia 31.96 30.28

Spain 6.1 6.6

Sweden 3.35 2.91

Switzerland 3.89 4.00

Turkey 8.73 16.65

Ukraine 12.43 11.89

UK 14.49 13.91

USA 76.02 91.27

What systems of relationships do the farmers have with the processors in Brazil, Germany, Ireland, Netherlands, New Zealand, Spain, Turkey and USA have that has encouraged them to grow their production?

LikeLike

Their industry’s and government have a plan for themselves and their nations which we do not have . We talk do reviews but do not follow through . Our industry leaders do not know how to work together and show some kind of unity. But they expect the farmers they represent to stand behind them and support their decisions. Farmers lack of unity and confusion about their futures is just a reflection of their leadership. Before people will follow their leaders need to show they have a plan and can work together. Until then farmers will not give them much respect ,Let alone be listening to their messages . So we remain rudderless and our industry flounders for crisis to crisis.

LikeLike

Which is why relying on the same failed ideology will continue to fail and why farmers need to take control of the element of supply via the National Milk Pool proposal

LikeLike

I get the idea of a National Milk Pool. It is logical and makes sense. The difficulty with the idea is that the pathway from here to there is impossible to negotiate. The only way we could ‘vest’ the national milk pool would be through some pretty serious acts of parliament that would defy the National Competition Policy. We have to have solutions that are ‘do-able’ from where we are now. That is why we need to address the anti-competitive contracting. That is in line with the National Competition Policy and doesn’t need an act of parliament. We need contracts that are fair.

LikeLike

I agree, we cant replicate what the NZDB got from the government to become Fonterra, It just isn’t possible here and will never happen as will a national milk pool with it but contract normalising is one thing that can be done as well as a few other things that have been put forward through other more commercially / politically focused platforms and media outlets.

Poor old (I use this term very loosely) Milk Maid must feel she is fast becoming the voice for the unheard on this highly topical debate.

LikeLike

Not “poor”, at all, CCD. Really happy to offer a forum for discussion and grateful for your comments. That’s the whole point of the blog!

LikeLike

The Australian recently had an article on farmers walking out of Murray Goulburn. What’s the latest on whether Fonterra, Saputo, Parmalat, Tatura and other processors having the capacity to absorb more milk supply? I suppose Fonterra will have capacity once its new plant starts operations in 2017.

LikeLike

The National Milk pool as we put it to government does not fall foul of competition policy.

As a voluntary pool that collectively bargains for the good of all within the true co-op. That is its greatest strength and weakness.

the more milk and unity for farmers vs retailers and processors the better outcome. Effectively what MG should be but hasn’t been for a long time and cannot into the future

LikeLike

Pingback: Could this have been the wake-up call Aussie dairy needed? | The Milk Maid Marian

Just wondering, how this is all working when this months pay check from MG to several folks was in the hand $4:70 and Several Warrnambool cheese suppliers was $3:96, who’s getting the raw end if the deal here?? Far far too complicated and oh so not transparent!

LikeLike