I’ve had requests from farmers, investors, the media and even politicians for an explanation of how milk prices work (or don’t). I’m going to start with the factors that affect the price a dairy farmer in Australia’s south-eastern states receives.

- Who buys Old Macdonald’s milk?

The opening prices of most of the processors are in:

ACM $5.30

Bega $5.00

Lion (variable option) $5.00

NDP $5.00

Warrnambool Cheese & Butter $4.80

Fonterra $4.73

Longwarry $4.60

Burra Foods $4.40 to $4.60

Murray Goulburn $4.31

ADFC To be advised

It’s a massive spread of prices, with the top almost 25 per cent higher than the bottom. And it doesn’t stop there. The pricing systems are incredibly complex, with the prices no more than weighted averages. I know of a farmer supplying MG, for instance, who will receive just $3.79kg MS for his milk. I’ll explain that later in this post.

But, why, you ask, doesn’t Old Macdonald simply choose the buyer with the highest price?

It’s easy to change factories. You just call, make an appointment, fill in some forms and voila, a new sign hangs on the gate! But the reality is that there are lots of other factors in play:

- Not all processors collect milk in every region. ACM, for example, does not collect milk from Milk Maid Marian’s district.

- Many farmers are tied up with debts to their current processor or incentives for flat milk supply that would see them penalised tens of thousands of dollars for leaving.

- Some farmers are contractually bound to the processor as part of share acquisition or “Next Gen” programs.

- Then, there’s the waiting list. Processors tell me that since the opening prices were announced, there are hundreds of millions of litres of milk on waiting lists for new homes right now. The processors will cherry-pick those that suit their ideal profiles. In fact, many processors already have too much milk and have simply closed their books.

2. The breed of cows and what they’re fed

As a rule of thumb, if you’re not familiar with this industry pricing, you can convert prices expressed in kilograms of milk solids (kg MS) into cents per litre (cpl) by dividing by 13. So, $5.30 per kg of milk solids equates to 41 cents per litre and $4.31 equates to 33 cents.

It’s a formula that works pretty well for the 80% of Australian dairy cows that are the classic black-and-white Holsteins.

But not if your cows are Jerseys. Around 11% of Australian dairy cows are Jerseys, which produce around 30% less milk than Holstein Friesians but a lot more fat for every litre. According to ADHIS statistics, HF cows’ milk contains an average 3.83% butterfat and 3.24% protein, while Jersey milk is creamier at 4.76 % fat and 3.67 % protein. This means that returns from Jerseys appear higher than those of HF in terms of cpl and lower in terms of dollars per kg MS.

3. When the cows give the most milk

Every cow produces no milk for two months until she calves, then her milk production increases steeply for a couple of months before tapering off again. We call this her “lactation curve” and when you add together all the herd members’ curves, you get a farm’s “milk supply curve”.

It makes sense to have the herd’s milk production peak when there is the most grass in the paddocks. Inevitably, that’s in Spring. Of course, if all herds peaked in Spring, it would cause big trouble for the processors. The entire Australian dairy milk supply is getting less and less seasonal over time because the processors offer more money for “off peak” milk.

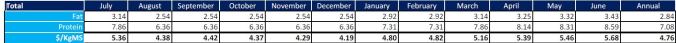

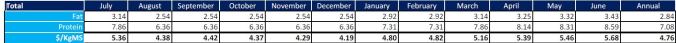

Here’s an excerpt from my own farm’s income estimate to show you just how much the price changes over the year with Fonterra.

For MG suppliers, the shift can be far more dramatic if suppliers elect to provide “flat milk” but I would need to dedicate a blog post to explaining this aspect of its system.

The differences in payment systems mean that even if a farm receives the average milk price from one processor, it might not from another.

4. Compulsory charges and levies

Most processors have compulsory charges that come off the headline price. These are not trivial and amount to tens of thousands of dollars. In my farm’s case, we pay a transport levy that amounts to 35 cents for every kilogram of milk solids we sell. On top of these, there are Dairy Australia and Dairy Food Safety Victoria levies.

5. Bonuses for the big and beautiful

If you think you’re across all that, don’t forget there are productivity incentives that favour larger farms and MG still has a growth incentive for farms supplying more milk than the year before. These can be very significant. There are also quality bonuses (and/or penalties) with different processors having different benchmarks.

6. Clawbacks

As you might already know, both MG and Fonterra dramatically dropped their prices for May and June to bring back the overall price. They have both come up with “support packages” for suppliers. Farmers are now beginning to pay for those. Fonterra suppliers are on interest-only this year and principal repayments will begin in the next financial year. MG suppliers are paying off their packages in the form of an artificially-lowered milk price already.

7. Special deals

Farmers were outraged back in 2012 when it was revealed that even the co-op was offering special deals for the really big farms. Nobody can say for sure how common these are today.

The bottom line is that every farmer needs to get an individual income estimate from processors to be sure what their milk price really is and what it would be if they supplied a different factory. Not all milk is created equal.

In April and May, we were using the very last of our dam water in a desperate attempt to get grass out of the ground. Two weeks ago, we had floods and the cows missed two milkings, trapped on the flats despite valiant attempts to bring them home.

In April and May, we were using the very last of our dam water in a desperate attempt to get grass out of the ground. Two weeks ago, we had floods and the cows missed two milkings, trapped on the flats despite valiant attempts to bring them home.