Buckle up. That’s the message threaded right through a report on Australia’s dairy supply chain by Rabobank‘s Michael Harvey released today.

While so many of us are aching for some stability, for things to just settle down a bit, the report crystallizes fears that change has only just begun.

Michael’s report cites three causes for continuing change:

- Down by 800 million litres in southern Australia, milk production is at its lowest in two decades

- Australia’s largest processor, MG, has “stumbled and remains under pressure”

- The lower price farmers are paid for milk has triggered a boom in stainless steel investment and aggressive recruitment

The scale of the shake up is huge

p. 2, Harvey M., (2017), The Australian Dairy Supply Chain

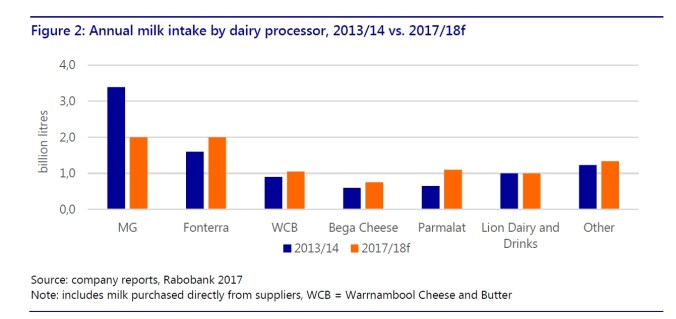

While Rabobank’s chart illustrates just how much milk MG has hemorrhaged, it also shows that MG continues to be a critical player in the whole industry’s fortunes. As does Fonterra, now more than ever.

Fonterra is abandoning the Bonlac Supply Agreement, which used the MG price as a guaranteed baseline, for something yet to be announced.

MG, the Rabobank report concludes, has suffered “structural damage” that will, if it can recover, take years to repair before the co-op can resume the role of price setter.

So, here is the kicker in Michael Harvey’s own words:

“The reality is that the old system of price discovery for raw milk has broken down and a new method of price discovery will need to emerge, meaning that, in the future, dairy farm operators will be operating in a more commercially oriented and flexible market for their milk.”

– p. 4, Harvey M., (2017), The Australian Dairy Supply Chain

Is it a warning? Perhaps. Change is often difficult but it brings fresh opportunities, too.

Competition will drive farmgate milk prices for a while

Rabobank notes that while milk supply has fallen by 800 million litres, enough new stainless steel is coming on line this year to process another 700 million litres, with more expansion planned. It expects competition to drive milk prices in the medium term.

Milk flowing beyond borders

According to the report, there is an increasing appetite for milk processors to spread supply risk beyond their traditional collection areas.

We’ve seen this locally, with Warrnambool Cheese & Butter, for example, recruiting milk in Gippsland.

A rethink of the current price system

Michael Harvey devotes a significant portion of the report considering the impact of the production decline on Australia’s status as a preferred supplier. “Alarm bells are ringing for international customers,” he writes.

In this context, Mr Harvey also discusses the tension between the need for flat milk supply versus the lowest cost of milk production – on one hand processors can’t manage a very “peaky” supply and, on the other, the discounting of Spring milk has forced up the cost of production for farmers, stifling growth.

Let’s just hope that out of this crisis comes a fresh start.