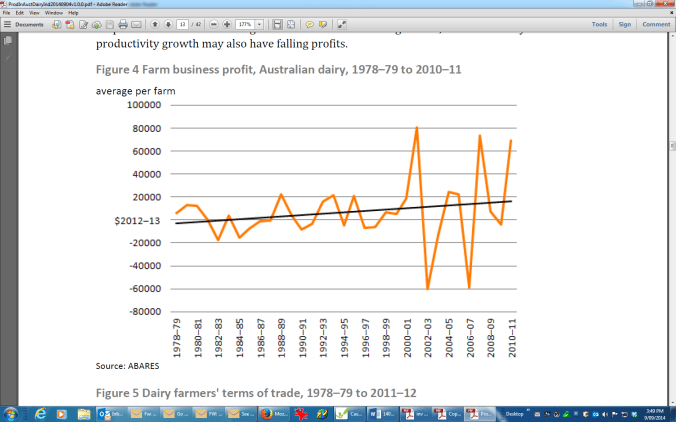

When the two biggest processors of Australia’s milk, Murray Goulburn and Fonterra, squandered the goodwill of farmers earlier this year, there was a sense they could do as they wished. They made the rules and broke them, too.

One executive told me there was no risk of supply loss following the drastic price cuts, saying, “After all, where would they (farmer suppliers) go?”.

How things have changed. Both the big processors have watched milk supply evaporate and, with the dawning realisation that something had to be done to avoid the death spiral outlined here and detailed by MG’s own advisors, Grant Samuel, both have responded.

After suspending the MSSP while reducing the forecast close by about the same amount a week earlier, MG made amends with a step-up the day before its AGM.

In his AGM address, MG chairman Phil Tracy acknowledged farmers’ pain and offered an apology of sorts.

“While as a Board, we did what we could with the information that we had at the time, we know that the outcomes of that period have been devastating for suppliers and for that we are deeply sorry.” – Phil Tracy, MG Chairman

Like MG, Fonterra Australia has announced it is reviewing the way farmers are paid for milk in order to avoid a repeat of the May debacle. Farmers whose milk production peaked in May and June were initially singled out for a thumping, causing many to sell off cows, only for Fonterra to back-track days later and spread the pain of its price cut more evenly among suppliers.

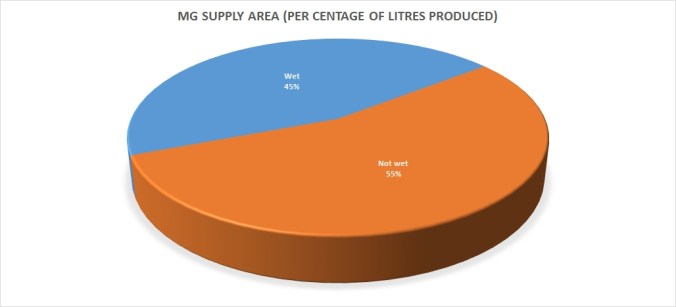

Despite poaching 200 million litres of milk from MG, Fonterra Australia’s supply remained fragile, due to the tricky season, the low milk price and the damage done in May to autumn-calving regions. Hours after MG announced its step-up, Fonterra came out with its own, much larger (and incredibly welcome), price increase.

The size of the step-up challenged the oft-held belief that Fonterra only pays the price it needs to in order to prevent supply loss to MG. With profitability restored, perhaps Fonterra has indeed extended its co-operative spirit to this side of the Tasman. On the other hand, Fonterra’s announcement provided a hint that perhaps it was essential to fill under-utilised stainless steel:

“The last six months have been challenging for all of you, and we know that spring is critical to optimise production.” – Matt Watt, Fonterra Australia

No matter what the motivation, it’s enormously heartening to see the two biggest processors act and act so positively. Maybe this is the wake-up call Australian dairy had to have. It might even help to rekindle the traditional sense of partnership between farmer and factory that had been on the wane for so long.

What’s certain is that farmers – and their supply of milk – can no longer be taken for granted. Loyalties have been stretched or broken and farmers who have now experienced how easy and rewarding it can be to shift their supply may well be tempted to do so again.

In return, expect processors to lock in a broader range of “desirable” supply with more special deals and contracts. Be careful what you sign. I’m tipping the unfair contract law that came into force quietly this weekend will be more important for dairy farmers than legislators could have imagined.