Today, Murray Goulburn Co-op stepped up its offer for Warrnambool Cheese and Butter again, to a staggering $9.50 per share. In a year where most dairy farmers are still playing catch-up from a horror stretch, it’s no surprise that some of us are getting nervous about how the deal stacks up.

I wanted to put the top nine the questions I’ve heard from farmers to one of MG’s most senior people, general manager shareholder relations Robert Poole. His responses have just arrived. Let me know what you think!

1. Where is the money for the bid coming from?

Murray Goulburn has committed financing facilities available from its existing lenders to fund the Offer. A further $350 million of new facilities have been provided by National Australia Bank (NAB), Australia and New Zealand Banking Group (ANZ) and Westpac Banking Corporation (WBC) in order to finance the transaction and assume Warrnambool’s facilities to the extent required. The support of the financiers in providing these facilities re-enforces Murray Goulburn’s views that the rationale and financial metrics implied by the offer are sensible.

It also confirms MG management and the Board’s view that the level of leverage in the business is appropriate for a co-operative structure particularly in its current phase of significant growth and investment.

2. MG’s balance sheet is described by commentators as “over-stretched”. Gary Helou countered by saying cooperatives are different. In what way?

Our offer is financially prudent and has been well considered. Our gearing will increase to around 57.2% – a level that our Board is comfortable with taking into account that we are a 100% farmer controlled cooperative with a range of options. At the financial year just ended our gearing was 43%. Based on a successful transaction, our FY14 gearing is estimated to be around 57%.

Co-ops are generally well supported by banks and this is the case with MG. Our bid for WCB is fully funded by NAB, Westpac and ANZ. Co-ops are not listed and are backed by their farmer suppliers. The capacity of the co-op model to sustain debt is well established and is evidenced by offshore examples most recently and notably Fonterra prior to their raising of non-voting equity capital. Co-ops traditionally have a higher level of debt. For example, Fonterra reached gearing levels of over 60% during growth phases.

3. How can you justify paying so much more than WCB’s stated “fair value”?

MG has carefully assessed the value of WCB, and our Offer is financially prudent and well considered. MG would NOT proceed with any bid unless the result added to the overall milk price and our analysis shows that a combination of WCB and MG will do just that.

This is an extremely complex and ever changing situation. However what is clear is that the industry needs consolidation to improve the efficiency of the supply chain and create a larger scale globally relevant Australian dairy food company, uniquely positioned to capture the unfolding long-term opportunity in international dairy markets. We believe it is vital that the co-operative has a central role to play in this – to build a strong farmer-owned business that can compete on a global scale against the other giant dairy co-operatives like Fonterra, Dairy Farmers of America, Friesland Campina and Arla – not to mention multi-national giants like Nestle and Kraft. MG is the only partner for WCB that has the scale and co-op structure to invest, grow and maximise farmgate returns for farmers, and ultimately regional communities. We remain committed to acquiring WCB, satisfying our conditions and delivering the benefits of the combination back to the farmgate. This can only be good for local investment, jobs and communities.

4. Can MG guarantee that its WCB bid will not damage the farm gate milk price? If so, how?

MG would NOT proceed with any bid unless the result added to the overall milk price and our analysis shows that a combination of WCB and MG will do just that. MG itself is entering an exciting phase of growth and has identified a series of strategic capital investments that will target a $1.00 per kilogram of milk solids lift underlying farmgate milk prices over a five year period from FY12 to F17. MG will deliver these benefits to supplier shareholders including those WCB suppliers who join the co-operative regardless of the outcome of the WCB bids.

5. Competition is often said to be healthy for businesses. Doesn’t a strong competitor for milk supply help to keep MG on its toes?

I would counter that it is MG that keeps competitors on their toes, as we traditionally lead the market on farmgate pricing. As a 100% farmer controlled co-operative MG’s primary objective will always be to maximise farmgate returns for our supplier/shareholders. As opposed to competitors who have the primary objective of maximising profits to their shareholders.

MG is the only partner for WCB that has the scale and co-op structure to invest, grow and maximise farmgate returns for farmers, and ultimately regional communities.

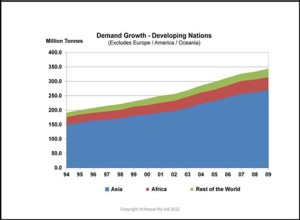

The current structure has not served the industry well over the last decade. The Australian industry has gone backwards while Asian demand has grown significantly – Australia is now a less relevant player in the international markets than it was in 2002. This has coincided with the drought, deregulation of the dairy industry and investment by foreign players.

Increased participation by foreign players has not lead to a restructure of the processing industry – the processing structure remains extremely fragmented. While foreign players have been in Australia for some time, they have not driven growth for Australian dairy products in the international markets.

MG’s own strategic plans and the proposal for WCB will assist in leading the Australian dairy industry to recovery and growth over the longer term. Our proposal is the one that creates a larger-scale globally competitive Australian dairy company uniquely positioned to capture growth in international dairy markets. Our plans involve investing and growing the businesses to meet the opportunities.

6. Why do you think farmers tend to be polarised in their attitudes towards MG?

I can’t comment on why. However, what I can say is that in recent years MG has been committed to improving and building relationships with dairy farmers and this has been underpinned by meaningful, in depth engagement and transparency. We believe this is yielding some very positive long term results for both the farmers and their co-operative.

We respect that people will have differing opinions however we welcome the opportunity to talk with any farmers to clarify questions, share our plans and our vision for the industry, as we did this week in Warrnambool and Mt Gambier.

We will continue to work hard to demonstrate to WCB and other dairy farmers the benefits and importance of becoming a supplier/shareholder of the co-operative. We believe we have a compelling story and look forward to talking to WCB dairy farmers about our offer and the opportunity for them to become part of the co-op.

7. How has MG’s culture changed in the last few years?

Over the past few years MG has been on a journey to become a more efficient and effective co-operative that can return more, and contribute more to its supplier shareholders, their communities and the industry as a whole. There is no doubt this has been reflected in the culture of our business, while remaining true to the co-ops core objective of maximising total farmgate returns. In addition, to a focus on improving and building relationships with dairy farmers, corporate governance has also been a priority, including developing Board and Committee Charters and formalising policies such as Public Disclosure, Risk Management and a Code of Conduct. Over the past couple of years MG has also had Board renewal with a number of new supplier Directors being appointed, appointing two specialist Directors; as well as the appointment of a new executive management team, including Managing Director, Gary Helou.

8. How differently do you expect to run the Allansford factory? Can its workers feel secure?

Foremost our bid is about investing and growing the MG/WCB business to increase scale and maximise farmgate returns. We see significant potential and this can only be good for local investment, jobs and communities. Both the MG and WCB processing facilities are already operating at or near capacity and they are making different products which makes them complementary. Down the track, we may identify operating efficiencies and if we do, these will flow through to the farmgate price and ultimately to farmers and their communities. That said we believe there will be substantial opportunities for existing employees in an enlarged group with national and global reach.

Our proposal is the one that creates a larger-scale globally competitive Australian dairy company uniquely positioned to capture growth in international dairy markets. Our plans involve investing and growing the businesses to meet the opportunities.

9. Aside from size, how would MGW compare to Fonterra?

Fonterra has become a highly successful global dairy giant and we believe that MG now has a similar opportunity before it. The combined business will be positioned to capture the unfolding long-term opportunity in international dairy markets. A combined MG/WCB would create one of the largest Australian owned food and beverage businesses, 100% controlled by dairy farmers, making us a top 20 global dairy producer. To put it another way when combined we’ll have forecast revenues (FY14) of $3.2b and be one of Australia’s top 5 food and beverage businesses, behind Lion and Coca-Cola Amatil, Fonterra and JBS Australia.

The combination will give us the necessary scale, market reach and efficiencies, and like Fonterra, we will have far greater relevance in export markets to be able to grow the brands and products from each business.

The combined business will have over 3000 suppliers, approximately 4 billion litres of milk processed annually, a diverse product range and market reach, forecast revenue of $3.2 billion (2014), diverse operations and a strong production base in Australia’s best producing dairy regions.

So this is an historic opportunity for Murray Goulburn and WCB suppliers and shareholders to create a larger scale, globally competitive Australian dairy food company that they own and control. Importantly, it will retain the primary objectives of a co-operative in maximising farmgate returns for farmer owners. It will also support on-farm and industry investment, and in turn grow the Australian dairy industry for the benefit of regional communities.