Wayne said the other day that the farm has taught him something about resilience: live in the moment when the sun is shining and, when the hail stings your skin, think of the big picture.

But the big picture right now is confusing for this Milk Maid. The WCB war has thrust the outlook for Australian dairy into the headlines and, with it, a lot of questions.

Our co-op has offered half a billion dollars for WCB, claiming that its loss to a global player would be “a tragedy”. In its statement to the ASX, MG Co-op said:

“The combination of MG and WCB is the only option available that delivers an Australian-owned and operated company with the scale, capacity, strength and momentum to service global growth opportunities, returning profits to dairy farmers and their communities.”

In the midst of all this, the UDV hosted a farmer forum on Monday where independent dairy analyst, Dr Jon Hauser, told farmers that supporting cooperatives is a “no brainer” but has also said the golden era of dairy in Asia was “largely rhetoric” and that real progress for Australian dairy would come through cost control and increased efficiencies at the farm and the factory.

He created a stir at the forum too, simply by saying that milk prices of 48 to 50 cents per litre could not be sustained. Not popular news.

So, now that Saputo is on the cusp of announcing a new offer, prompting WCB to ask for a suspension of trade, what if Helou’s tragedy does unfold? How will the General regroup?

MG will certainly have to work harder to woo those who harbour a co-operative spirit but supply other processors. And that, I’m afraid, is something the co-op has not done well to date, in my view. Perhaps the tide is beginning to turn, reading between the lines of Helou’s interview with The Weekly Times dairy writer, Simone Smith, headlined Divided we fall:

“There is nothing stopping our farmers rallying around a well-run farmer run company that is of scale and relevance.”

“There is no law in the land against that. That’s what we are advocating. This rally around the MG foundation to create a new farmer-owned business that is really relevant to the 21st century.

“The farmers will only benefit from direct ownership and direct influence in supply chain from the farm all the way to market.”

I guess we farmers are used to falling and getting back up again.

UPDATE: In response to a question asked below, Dr Hauser has kindly sent me this. I don’t know how to put it – complete with charts – in the comments section, so here it is instead:

Sorry Marian, It would take me a day to properly represent my position on the Asian growth story and even more to update my analysis to the most recent trade data.

Here is a snapshot of the important data:

This is the demand growth for the developing nations. This comes from the FAO

Most of this growth has been serviced by internal development of their dairy industries.

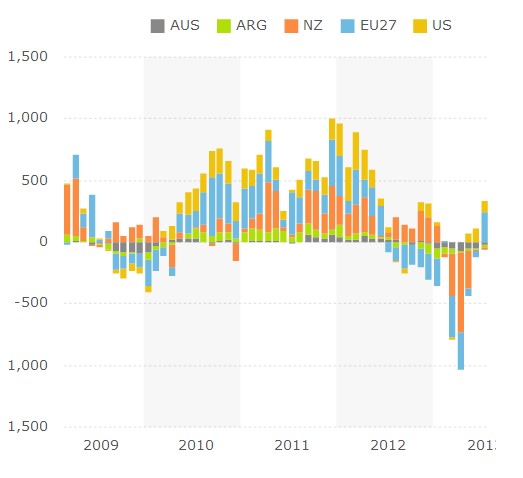

This the export growth from the key dairy traders – Europe, US, NZ, Argentina, Australia. The average is 2 – 3 billion litres / year. Even if this has been accelerating in the past few years it is unlikely that the opportunity is more than 4 – 5 billion litres / year. I believe the average growth opportunity for the global traders is 3 – 4 billion litres but I would need to review the more recent data to check this.

YOY Production milk production growth – Million Litres

This is the year on year growth that has come from the major traders. This chart shows 15 billion litres of growth from the EU, US, NZ and Argentina from July 2010 – June 2012. The total for the period from July 2009 – June 2012 is 12 billion. In other words we saw contraction in 2009 and 2012 and that is because the milk price was low. The US and Europe turn growth on or off according to commodity and milk price (New Zealand just keeps on trucking except when it doesn’t rain).

In summary:

- The Asia growth story is not rhetoric but the suggestion that the hole can’t or won’t be filled is.

- The US and Europe will turn on and off milk production according to demand and price. They had no difficulty growing supply at 5 billion litres / year in 2010 / 2011 and they are already gearing up to do it again in 2014.

- No I don’t subscribe to the analysis that has been done for the Horizon 2020 report. I believe the “Supply Gap” analysis is a flawed way of assessing Australia’s future export opportunity.